The team A committed collective

No results for

this search

Partners

-

![]()

Cyrille BAILLY Real Estate Transactions

-

![]()

François de BÉRARD Litigation

-

![]()

Cédric BONNET Financing

-

![]()

Émilie Capron Real Estate Transactions

-

![]()

Jean-Yves Charriau Tax

-

![]()

Irène COTTARIS Real Estate Transactions

-

![]()

Sophie DUBOY Tax

-

![]()

Anne-Laure Gauthier Public Law

-

![]()

Marie-Amélie GROS Real Estate Transactions

-

![]()

Damien GROSSE Real Estate Transactions

-

![]()

Vincent GUINOT Public Law

-

![]()

Guillaume JEANNET Real Estate Transactions

-

![]()

Nicolas JÜLLICH Mergers Acquisitions

-

![]()

Alexis LE LIEPVRE Litigation, Real Estate Transactions

-

![]()

Xavier de LESQUEN Public Law

-

![]()

Damien LUQUÉ Financial Services, Asset Management

-

![]()

Benoit NEVEU Public Law

-

![]()

Jean-Jacques Raquin Real Estate Transactions

-

![]()

Guillaume ROCHE Mergers Acquisitions

-

![]()

Renaud ROSSA Mergers Acquisitions

-

![]()

David SOREL Tax

-

![]()

Julien SOUYEAUX Tax

-

![]()

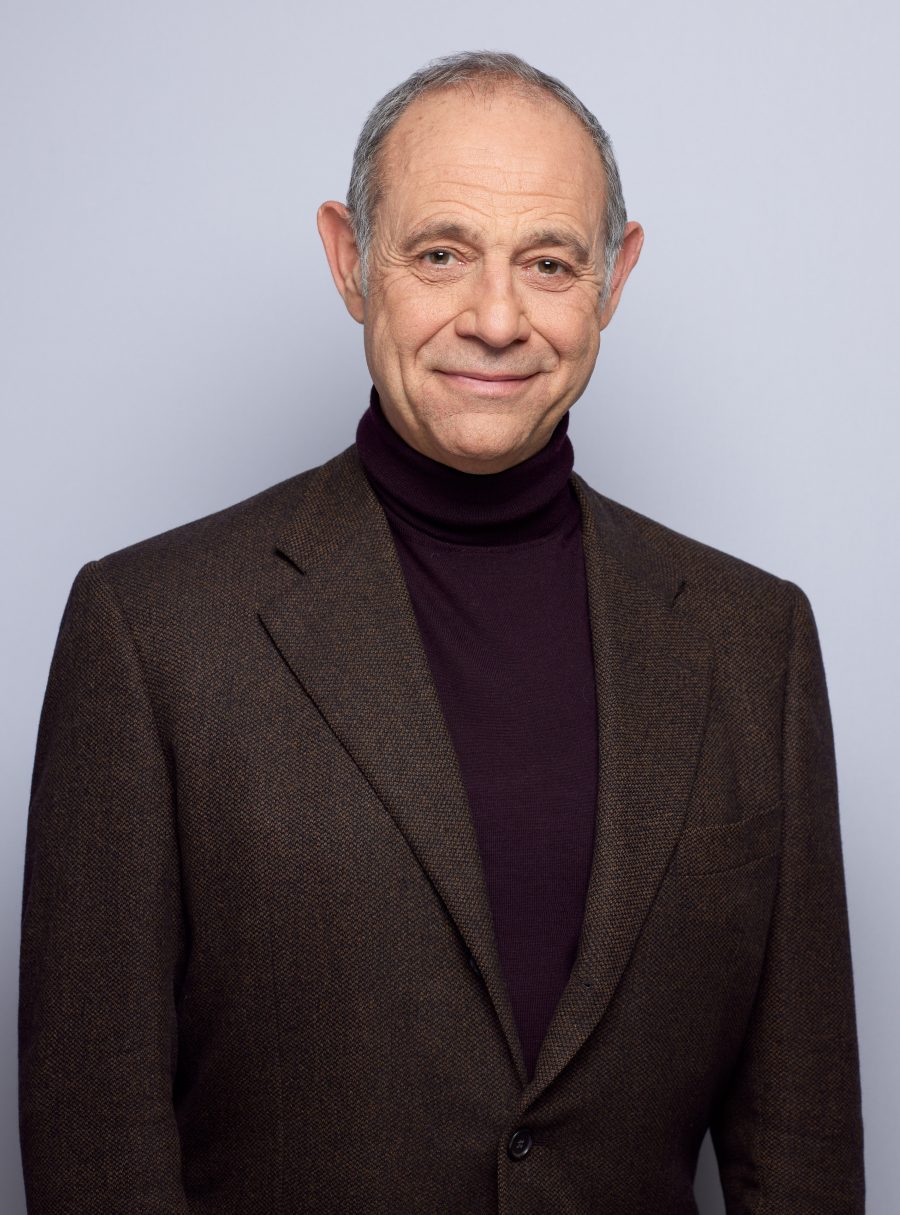

Serge Tatar Mergers Acquisitions

-

![]()

Chloé THIÉBLEMONT Financing, Real Estate Transactions

Associates

-

![]()

Juliette AMBLARD Real Estate Transactions

-

![]()

Félix AVENEL Public Law

-

![]()

Claire AVRIN Tax

-

![]()

Marlyn BALEMBOLO Real Estate Transactions

-

![]()

Evan BALLET-BAZ Tax

-

![]()

Samuel BALZANO Mergers Acquisitions

-

![]()

Céline BASSET-CHERCOT Mergers Acquisitions

-

![]()

Marion BEAUDOUIN Real Estate Transactions

-

![]()

Eugénie BOSSÉ Mergers Acquisitions

-

![]()

Gabriel de CHAMPEAUX Public Law

-

![]()

Sarah CHEMOUNY Mergers Acquisitions

-

![]()

Karen CHERMAT Real Estate Transactions

-

![]()

Anne-Sophie DA SILVA Real Estate Transactions

-

![]()

Christophe-Marc DABLON Mergers Acquisitions

-

![]()

Louise-Victoire DAVID Real Estate Transactions

-

![]()

Martin DELCAMP Real Estate Transactions

-

![]()

Pierre-Olivier DERRO Public Law

-

![]()

Joseph DESCHAMPS Mergers Acquisitions

-

![]()

Maya DEVEDEUX Financing

-

![]()

Maxime DI MARIA Financial Services, Asset Management

-

![]()

Martin DOURNEAU Litigation

-

![]()

Géraud DUPRÉ de PUGET Litigation

-

![]()

Romain DUVAL Real Estate Transactions

-

![]()

Olivier GATÉ Financing

-

![]()

Nina GILLES Real Estate Transactions, Litigation

-

![]()

Charles GONCALVES Public Law

-

![]()

Sarah Guegan Tax

-

![]()

Alexy HAMOUI Real Estate Transactions

-

![]()

Octave HOCHER Litigation

-

![]()

Marine HUE Public Law

-

![]()

Martin JARRIGE DE LA SIZERANNE Financial Services, Asset Management

-

![]()

Yoann Labbe Mergers Acquisitions

-

![]()

Arthur LASFARGUE Real Estate Transactions

-

![]()

Antoine LASSIER Mergers Acquisitions

-

![]()

Morgane LE BOLLOCH Tax

-

![]()

Christelle LE Financial Services, Asset Management

-

![]()

Myriam LE CORRE Real Estate Transactions

-

![]()

Aude Leprince Litigation

-

![]()

Enora MANGIN Tax

-

![]()

Paul MAZET Public Law, Real Estate Transactions

-

![]()

Claire McDONAGH Public Law

-

![]()

Romain MERESSE Public Law

-

![]()

Catherine MOUNIER Real Estate Transactions

-

![]()

Christian N'DA Tax

-

![]()

Delphine OLLIVIER Public Law

-

![]()

Akim OUINT Litigation

-

![]()

Sacha Partensky Mergers Acquisitions

-

![]()

Geoffrey PASTORELLI Litigation

-

![]()

Eléonore PELLETIER Financing

-

![]()

Valentine PETITJEAN Public Law

-

![]()

Alexia PHARÈS Mergers Acquisitions

-

![]()

Arthur Pierre Public Law

-

![]()

Clothilde REPETA Public Law

-

![]()

Lucile ROUSSELIN-JABOULAY Litigation

-

![]()

Camille TAUZIÈDE Financing

-

![]()

Lucile TAUZIN Real Estate Transactions